Introduction

The current crisis has brought new challenges to the ICT sector. Regulatory frameworks need to be adjusted to stimulate investment while maintaining a moderate level of competition. Markets and consumer benefits are now examined by decision-makers through the lens of financial adversity and uncertain outlooks.

Amid disruption, policy-makers and regulators need evidence-based guidance that provides a solid ground for their reforms.

A new ITU study has used econometric modelling to examine the impact of the regulatory and institutional frameworks on the performance of the ICT (Information Communication Technologies) sector and its contribution to the national economy as a whole. Its purpose is to provide policy-makers and regulators with the empirical evidence required to further regulatory reform in the ICT sector and address the challenges and gaps in current regulatory frameworks for digital services and applications.

The study scope explores a set of critical questions:

- What is the impact of government policies and regulation on the performance of the ICT sector, as measured by capital investment, network deployment, service pricing, consumer demand, and ultimately impact on the economy?

- Is competition enough of an incentive to drive an improvement of sector performance?

- How long does it take for changes in regulation and policies to affect sector performance? The modelling is built on data from 145 countries between 2008 and 2019 – an up-to-date global data set, comprising 50 initiatives of policy reforms and institutional characteristics as well as 13 indicators of ICT sector performance.

- The insights of the analysis are backed by authoritative data on the evolution of ICT regulation since 2007, the ICT Regulatory Tracker, and a global dataset on ICT markets economics.

Upgrading regulatory frameworks – what matters?

The evidence provided by the study points to major findings that are of great importance in informing governments, policy-makers, regulators and operators as they formulate general infrastructure and telecommunication investment decisions in the years ahead:

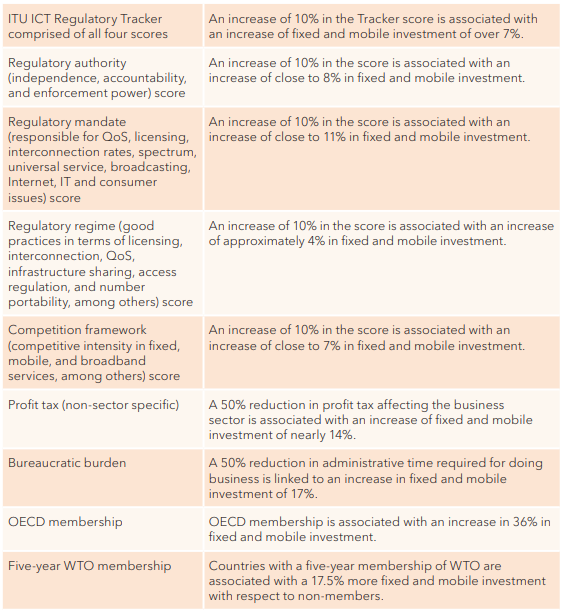

- The regulatory institutional framework, which is composed of regulatory authority, regulatory mandate, regulatory regime, and competition model, is linked to a positive and significant increase in telecommunication investment. This entails having a separate, independent and autonomous ICT regulator with a wide scope in its attributes, adopting the best regulatory practices (encompassing the licence regime, service quality monitoring, spectrum sharing, etc.), and promoting a competitive environment.

- A reduction in taxation is associated with a significant boost in capital investment, as it increases available financial resources for network deployment.

- A reduction of government bureaucratic processes is linked to a significant increase of capital investment, confirming the relevance of public efficiency. This highlights the importance of reducing the required time for obtaining permits related to network deployment (for instance, through the adoption of “silence procedures1”), addressing municipal network construction requirements (by promoting a centralized norm of national scope), and reducing other red-tape costs.

- Being affiliated to international organizations that promote sound regulations and good practices to enhance a business-prone environment through a binding commitment for reforms (namely, Organisation for Economic Co-operation and Development (OECD) or World Trade Organization (WTO)) is linked to higher telecommunication investment.

Regulatory power boost for mobile

Specifically, for the mobile sector, the following policies were found to have a positive and significant impact on investment, yielding in turn service coverage gains, price reductions, higher adoption levels and consequently, a macroeconomic impact in terms of GDP per capita:

- The introduction of a national broadband plan (combined with a strong implementation framework and leadership), suggesting that the formulation of a digital agenda is crucial to accelerate innovation and boost investment.

- A convergent licensing framework, as it provides a flexible approach to ICT policies, more adapted to technological advances, maximizes the return of infrastructure investment.

- Allowing voluntary spectrum sharing agreements, thereby helping operators to maximize the opportunities to make investments profitable, represents an incentive for network deployment.

- The introduction of mobile number portability, that removes barriers and renders the market more dynamic, stimulates competition and innovation.

- Openness to foreign operators, increases access to capital for network development and modernization, and allows for the transfer of technology and know-how.

- The existence of a national competition authority contributes to monitoring multiple market segments in order to avoid anticompetitive actions.

On the other hand, other policy variables did not show a significant impact on investment. That is the case, for instance, of infrastructure sharing obligations, spectrum band migration allowance, or permission for spectrum secondary trading.

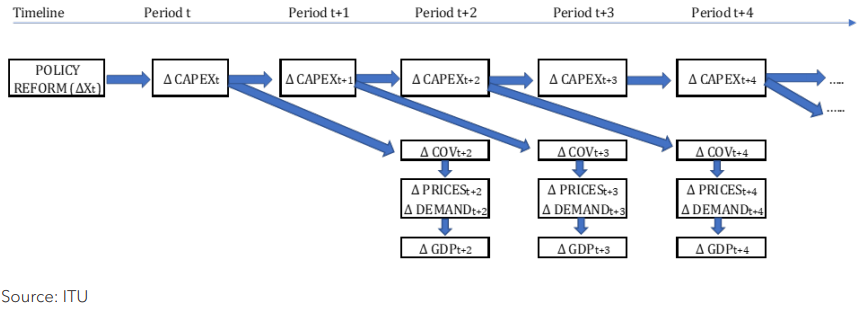

All in all, these findings suggest that positive market signals and flexible approaches are necessary conditions for telecommunication operators to thrive and maximize network deployment, benefitting consumers and the society as a whole. Given the dynamic nature of the empirical model, the positive impact from policy and institutional reforms will translate into further gains beyond a single time period, as capital spending in future years will continue to grow as a result of the increase in its own past values. This economic flow of performance gains can be summarized as follows (Figure A).

Dynamic economic gains after a policy reform in period t

Accordingly, the positive impact in terms of GDP per capita will take place two years after the initiative is enacted and continue to yield a contribution through several time periods. The empirical evidence generated in this study is expected to provide useful inputs to policy-makers in terms of a deeper understanding of the linkages between the regulatory and institutional context and ICT market outcomes, and on the characteristics that effective public policies should have. However, some caveats need to be made regarding the study results. Some of the indicators are limited in terms of their full predictability. For example, the binary nature of some of the initiatives (i.e., existence of a broadband plan yes/no) does not provide an indication of their intrinsic quality. On another note, the pandemic of COVID-19 is expected to have an incidence in the presented results. On the one hand, the GDP contraction experienced worldwide is affecting telecommunication revenues, negatively impacting capital spending levels. On the other hand, the lockdown period is resulting in an enhanced use of digital technologies, thus representing an unobservable shock increasing adoption levels. These effects will be econometrically measurable when 2020 data becomes available.

With these caveats, the results are powerful in terms of informing policy decisions. Regulators and policy-makers alike should assess the quality of the institutional framework guiding industry operations and examine whether some of the policies found to be critical in promoting an improvement of performance are in place. Even if they have been adopted, it is important to examine the policies in detail to determine how much they meet some of the international best practices.

At a glance headlines from the report

The full study on the impact of policies, regulation, and institutions on ICT sector performance is available here.